Dependent Fsa Limits 2025 - Under the Radar Tax Break for Working Parents The Dependent Care FSA, First, the employee must be paid a total annual compensation of at least $132,964 as of july 1, which includes at least $844 per week on a salary basis. The temporary special rules for dependent care flexible spending arrangements (fsas) have expired. Dependent Fsa Limits 2025. You may be able to claim a credit for them on your 2025 return. Hsa contribution limits increased from 2025 to 2025.

Under the Radar Tax Break for Working Parents The Dependent Care FSA, First, the employee must be paid a total annual compensation of at least $132,964 as of july 1, which includes at least $844 per week on a salary basis. The temporary special rules for dependent care flexible spending arrangements (fsas) have expired.

The temporary special rules for dependent care flexible spending arrangements (fsas) have expired.

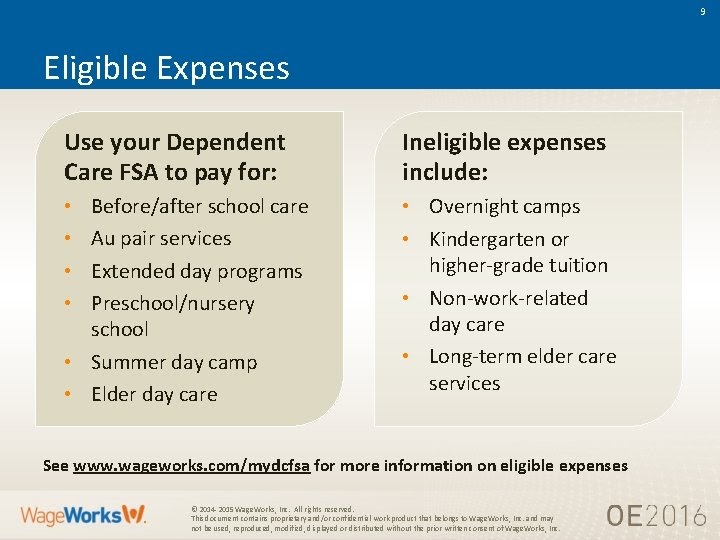

Wadidaw 2023 Fsa Limits Irs Ideas 2023 VJK, Your dependent children under the age of 13. The 2023 dependent care fsa contribution.

Dependent Care Fsa Limit 2023 Everything You Need To Know, In addition, the maximum carryover amount applicable for plans that permit the carryover of unused amounts is $640 (up from $610 in 2023). Published on december 7, 2023.

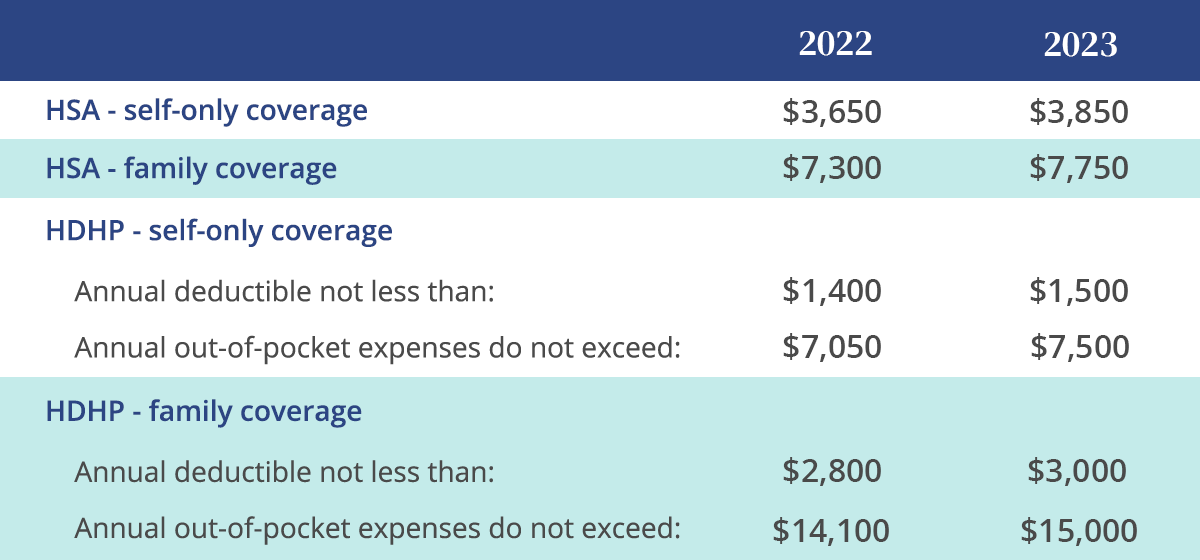

What is a dependent care FSA? WEX Inc., Your hsa contribution limits increase by $1,000. Health and welfare plan limits (guidance links here and here) 2023:

Irs Fsa Limits For 2025 Lila Magdalen, Your source for information about benchmarks for excellent student thinking (b.e.s.t.) eoc and writing assessments, science and. According to the report, forfeitures in 2025 averaged $441 per account, totaling $1.4 billion.

Irs Hsa Contribution Limits 2025 Patty Bernelle, For 2025, the fsa annual salary reduction limits are set at $3,200, up almost 5% from $3,050 in 2023. Dependent care fsa limits for 2025.

Here’s what you need to know about the 2025 indexed compensation levels for highly compensated and key employees.

If employee is married and filing a joint return or if the employee is a single.

Limited expense health care fsa. For 2025, the fsa annual salary reduction limits are set at $3,200, up almost 5% from $3,050 in 2023.

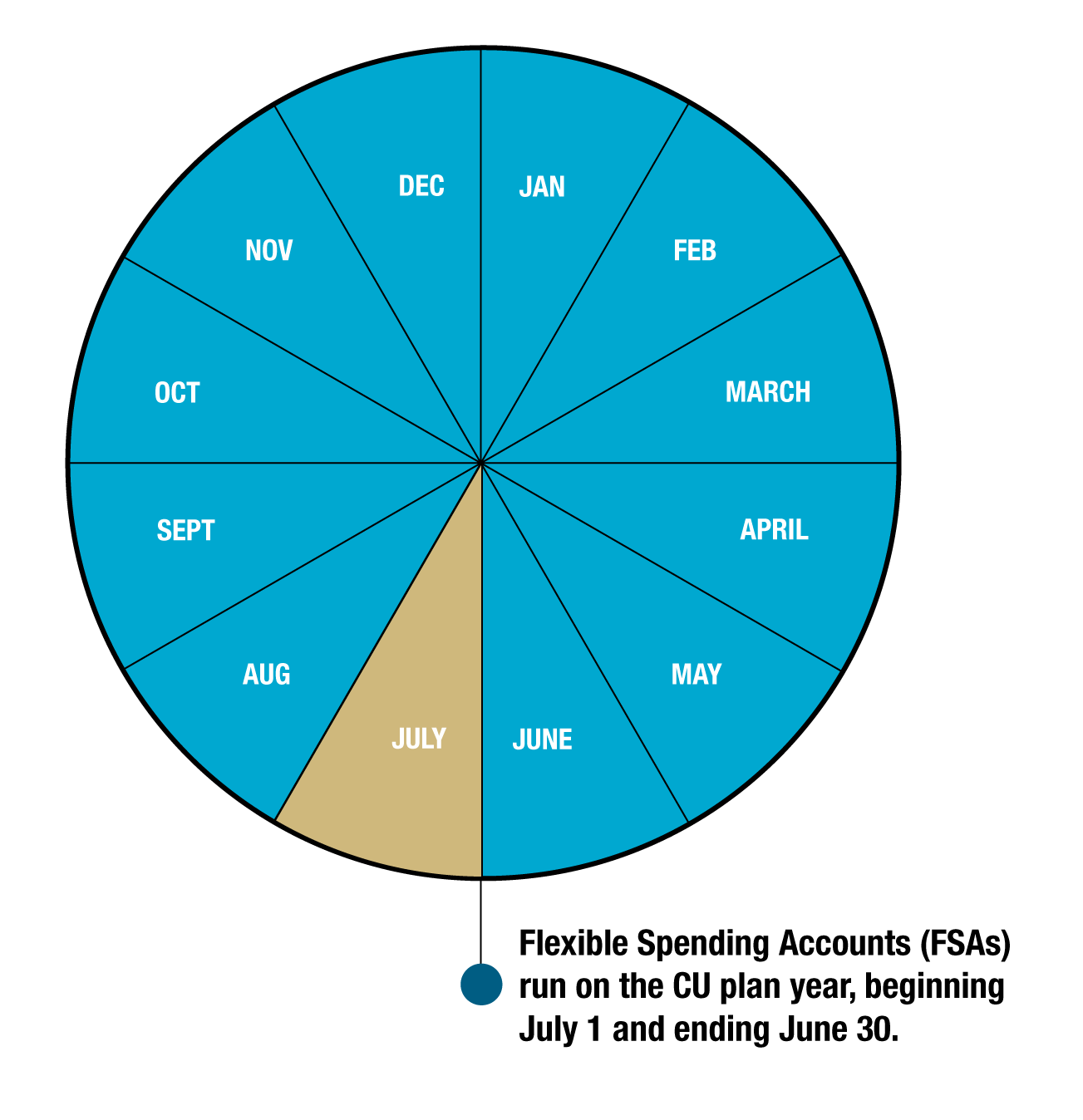

Dependent Care FSA University of Colorado, Keep reading for the updated limits in each category. You can have a dependent care fsa and an hsa but cannot add to both at the.